Research

A wealth of conversation: How Twitter connects those interested in finance and investment

Money talks or so the saying goes. On Twitter in the UK, people are certainly talking about money. In the wider buzz of conversation on Twitter in the past year, finance is a topic that has skyrocketed in volume.

Throughout the pandemic, partly because people have had more time, more and more Twitter users in the UK have turned to Twitter to discuss and learn about investment, cryptocurrencies, fintech, and more.

In May 2021 alone, Twitter saw 694,000 conversations about finance in the UK, close to doubling from 369,000 in January 2019. Many of these conversations spur action — 36% of UK users say they see financial and business news on Twitter that can affect their investment decisions.

One topic, in particular, has taken off in 2021, with a 49% increase in Tweets about cryptocurrency in the year after lockdown. In fact, half of the conversations around finance by UK Twitter users now revolve around cryptocurrencies, with a further third relating to personal finance and 11% to mortgages.

Stock sticker conversation has seen similar exponential growth to cryptocurrencies as a topic of discussion this year, although it comprises about 1% of finance-related conversations overall in the UK.

UK Twitter users talk investing

Over the past year, the volume of Tweets about personal finance by UK Twitter users has grown by 18%, while 38% of these users follow people and accounts on Twitter that discuss investments.

This is an investment-savvy group — 64% of UK Twitter users invest in stocks, bonds and funds, compared with 57% of non-Twitter users, while 14% invest in commodities, compared with the 10% of non-Twitter users who do.

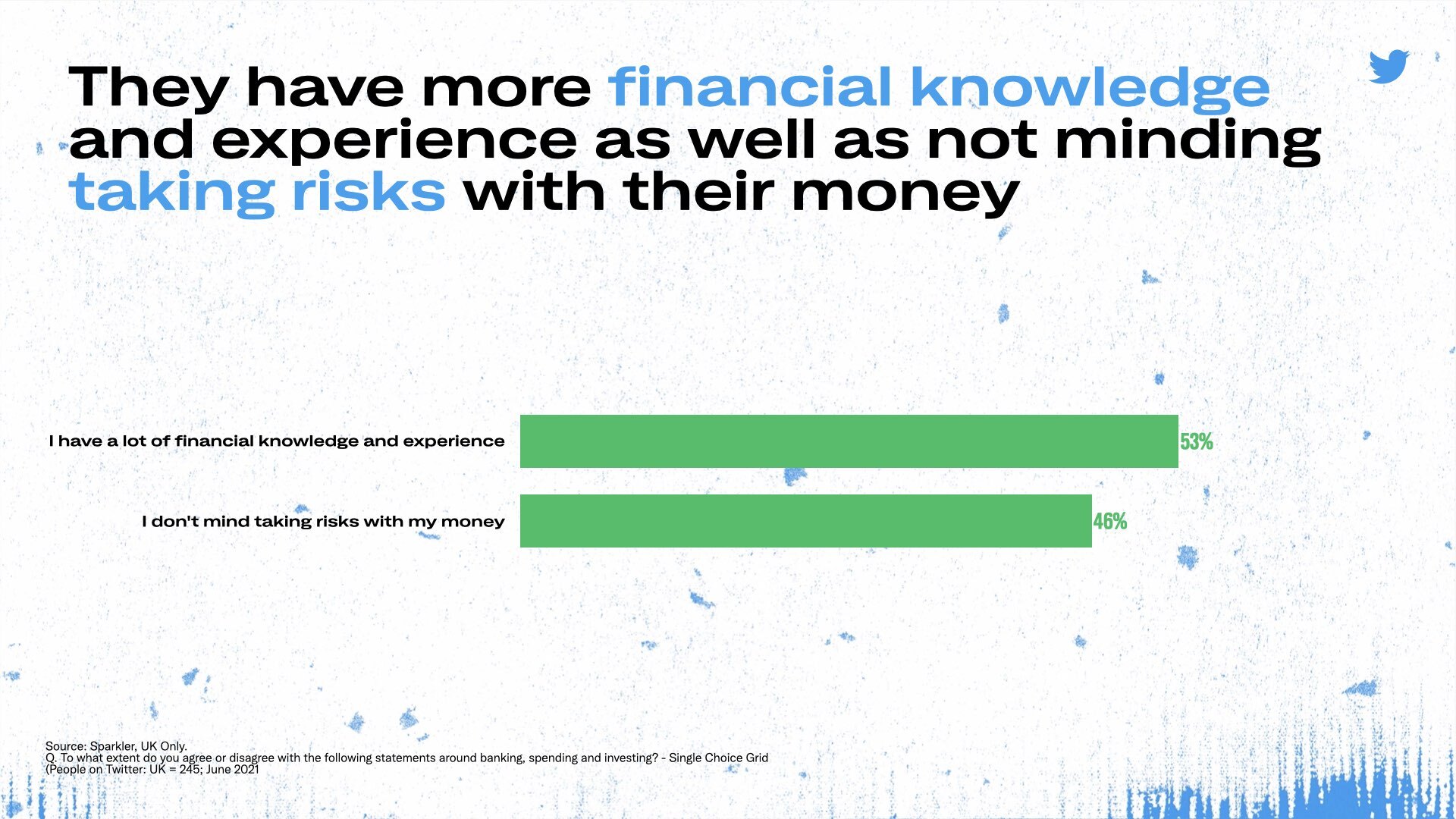

Not only that, but 39% of all UK Twitter users surveyed said the overall value of their investments has grown during the pandemic. Overall, 53% say they have a lot of financial knowledge and experience, and a sizeable 46% say they don’t mind taking risks with their money.

Interestingly, Twitter users in the UK were also more likely than non-Twitter users to have seen an increase in their overall income during the pandemic. They were even more likely to have increased their household spending on everyday purchases such as food over the past year.

When it comes to hobbies and other interests, this group of Twitter users is much more likely than the overall online population to be interested in Esports, gambling, computers, and coding.

More time during the pandemic to research investing

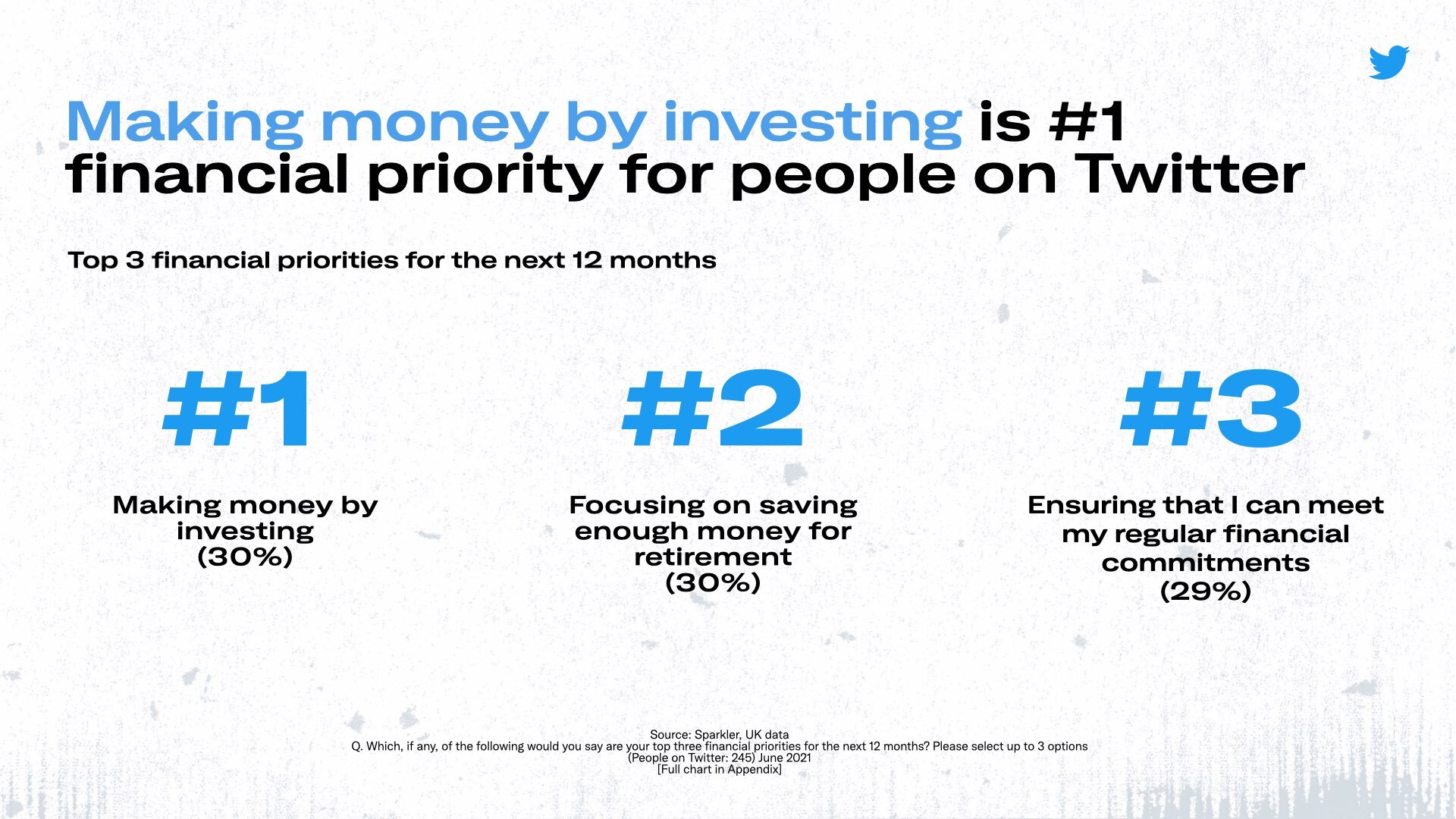

People on Twitter in the UK say making money by investing is one of their top financial priorities for the next 12 months, followed closely by saving for their retirement.

Of the UK Twitter users investing, 37% said they had done so for the first time since the start of the pandemic, with over half of those saying it was because they had more time to research potential investments. In fact, 16% of all Twitter users in the UK said they had used an online financial investment tool in the past month.

When those who are not currently investing were asked, half said they were considering investing in the stock market in the next six months, with 49% thinking of opening a savings account and 28% considering a move into property investment.

Fintech fans with rising crypto awareness

UK Twitter users show a keen interest in new fintech and new forms of payment, saving, and investing. Knowledge of different cryptocurrencies and wallets is high among them, for example, with 89% knowing about Bitcoin, 55% aware of Dogecoin, and 53% familiar with Ethereum. More than half are aware of crypto wallets such as eToro and Coinbase.

Of those who invest in cryptocurrency, 58% said they had invested more in it during the pandemic, while many of those who are not currently investing are more open to putting money into cryptocurrencies.

Overall, the UK Twitter population is confident in fintech, with 81% using contactless payments and 67% having used PayPal in the past month. Twitter users in the UK are also 40% more likely to have used Apple Pay than people in the UK in general.

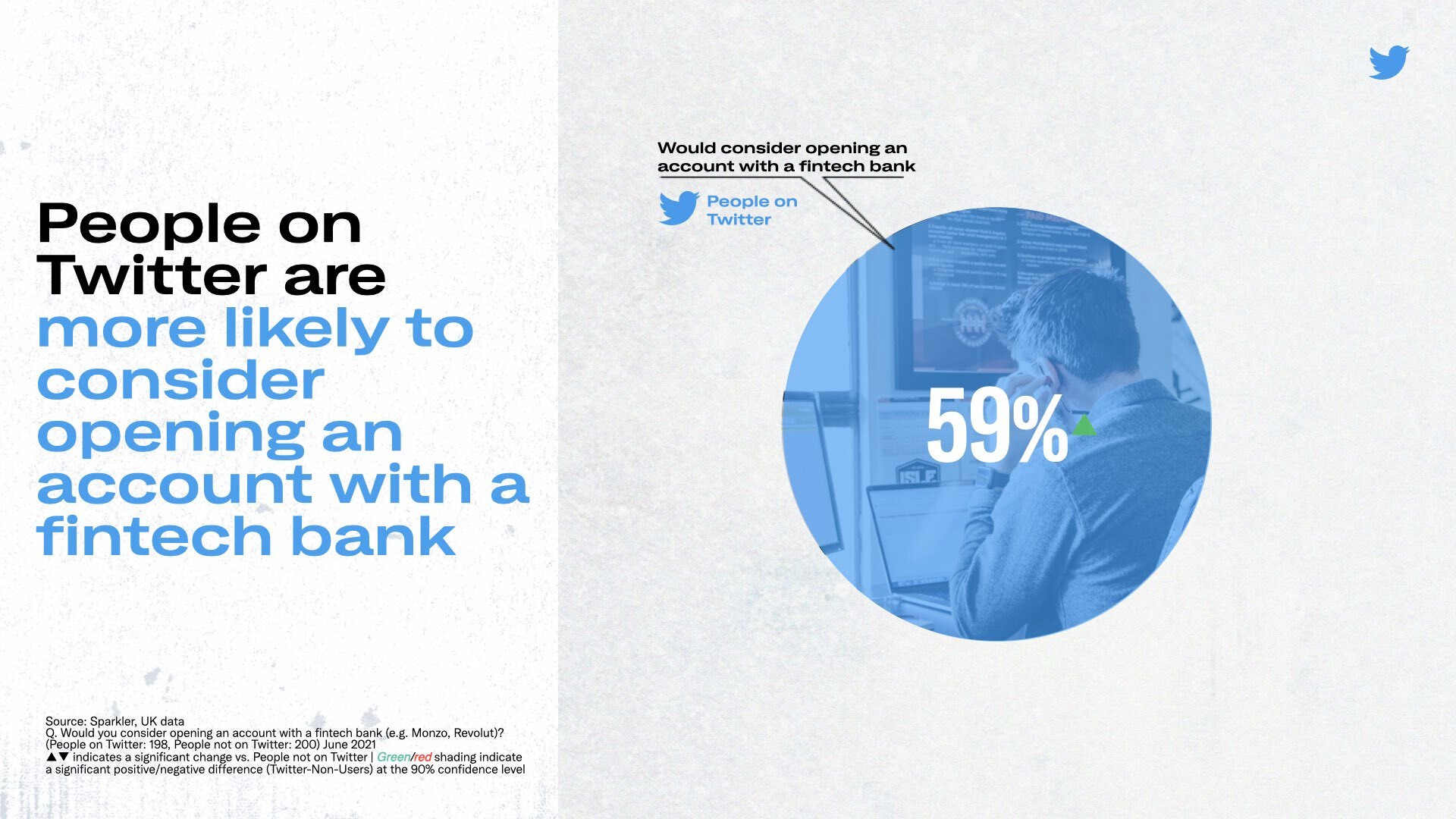

Similarly, they are markedly more likely to open a fintech account than people in the UK in general, with 59% saying they would. Those who wouldn’t use these banks pointed to customer service and interest rates as reasons, showcasing an opportunity for fintech banks to shape their messaging.

Asked which types of brands would be a good partnership fit for fintech banks, UK consumers on Twitter were much more likely than people, in general, to point to media, entertainment, and tech brands.

How finance brands are connecting to the conversation

With a wealth of conversations on Twitter, there is ample opportunity for finance brands to tap consumer interest.

As small businesses were hit by lockdown restrictions during 2020 and 2021, many brands have used Twitter to join the #ShopLocal conversation and rally around SMEs across the UK. American Express recently launched its annual #ShopSmall campaign, showcasing small businesses and encouraging the public to get involved.

Lloyds Bank Business (@LloydsBankBiz) has been taking a closer look at the entrepreneurs and business owners working their way through the challenges of the last year. Through its #LockdownLearnings campaign, the brand has focused on the resilience of business owners, and provided thought leadership from influential figures in the business community in the UK.

The growth of online shopping and fintech has provided scammers with new opportunities to defraud. HSBC (@HSBC_UK) has been working to educate people on the dangers of online fraud.

With such an active community fascinated by fintech, investment, and crypto, it’s clear that Twitter is the smart place for finance and investment brands to connect with potential customers in the UK.

Sources:

1. Brandwatch, commissioned by Twitter, mentions of finance terms and keywords, January 1st 2019 to May 31st 2021, UK

2. Sparkler/Twitter Insiders June 2021